how to file back taxes without records canada

In the Income Tax Act s. How far back can you go to file taxes in Canada.

Are My Business Tax Returns Public Advice For Small Businesses

Filing back tax returns could help you do one or more of the following.

. However to properly use tax accounting software and learn how to file back taxes without records. You can request information as far back as the past 10. The penalty for filing taxes late is 5.

Its easiest to pay every month to avoid a. This program is designed as a second chance to correct prior year returns or to file returns that have not been filed. However this is only the.

You dont have to be told there will be a. Offer helpful instructions and related details about How To File Back Taxes Without W2 - make it easier for users to find business information than ever. Read the article to learn how to file back taxes without records.

Put your Documents in Order. 230 states that you must retain all books and records for six years after the date the tax return is filed. According to the CRA a taxpayer has 10 years from the end of a calendar year to file an income tax return.

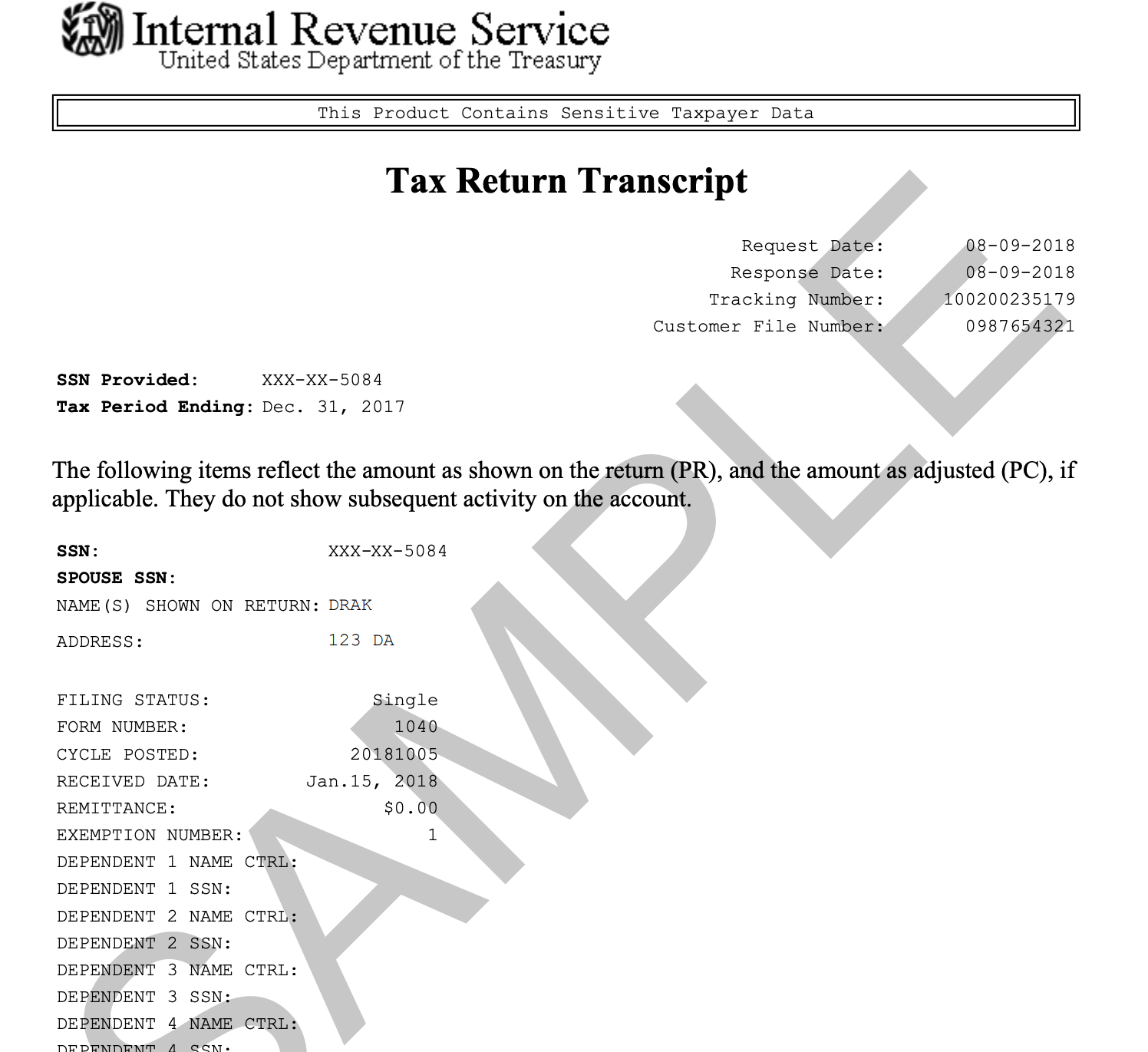

According to the CRA a taxpayer has 10 years from the end of a calendar year to file an income tax return. If you are missing records to correctly file your back taxes the transcript you want is the Wage and Income Transcript. Landlord Rental Income And Expenses Tracking Spreadsheet 5 110 Properties Being A.

Use CRA-approved tax software to calculate and file your taxes electronically. How to file back taxes without records canada Thursday September 1 2022 Edit. If you need wage and income information to help prepare a past due return complete Form 4506-T Request for Transcript of.

For filing help call 800-829-1040 or 800-829-4059 for TTYTDD. You can also order a tax return or tax. Options include online downloaded or installed on your computer mobile or tablet.

The penalty for filing taxes late is 5 of the tax years balance owing plus 1 of the balance owing for each full month your return is late up to a maximum of 12 months. Many taxpayers believe filing taxes is a time-intensive dull and complex chore. One practical reason to file a back tax return is to see if the IRS owes you a tax refund.

How Far Back Can You Go To File Taxes In Canada. You can still save yourself from IRS penalties if you have missing or incomplete tax records. Try it Free to help prepare for how to file back taxes without records.

Complete IRS Tax Forms Online or Print Government Tax. For most business owners the best and fastest way to get your tax transcripts is through the Get Transcript Online tool from the IRS. Prepare the tax return from the clients documents.

So although your tax returns are usually subject. The longer you go without filing. Ensure to complete and get your client to sign a Form T183 Information Return for Electronic Filing of an Individuals.

The more information you get concerning the Canadian tax system the better for you and your finances.

How To File A Late Tax Return In Canada

Haven T Filed Taxes In 1 2 3 5 Or 10 Years Impact By Year

The Best Online Tax Filing Software For 2022 Reviews By Wirecutter

Tax Documents Needed For Marriage Green Card Application

How To File Back Taxes Without Records Jackson Hewitt

A Guide To Filing Your Back Taxes Tax Relief Center

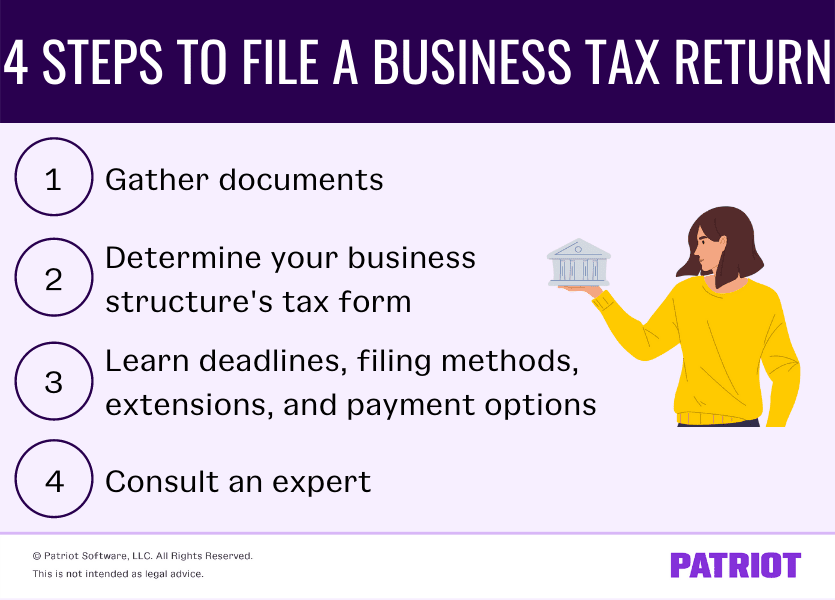

How To File A Small Business Tax Return Process And Deadlines

How To File Back Taxes In Canada Taxwatch Canada Llp

How To File Back Taxes Without Records Jackson Hewitt

Stripe Tax Automate Tax Collection On Your Stripe Transactions

The Best Online Tax Filing Software For 2022 Reviews By Wirecutter

T4 Slips What Canadian Employees Should Know Nerdwallet Canada

:max_bytes(150000):strip_icc()/tax-preparation-prices-and-fees-3193048_color2-HL-8b4b5382e1a44aa0864ed504d4ca5414.gif)

How Much Is Too Much To Pay For Tax Returns

Global Taxes Financial Services Fastspring

Doc Tax Tips How To Sort Tax Receipts Deducting Business Expenses Christopher Mark Macneill Academia Edu

Publication 54 2021 Tax Guide For U S Citizens And Resident Aliens Abroad Internal Revenue Service

Unfiled Taxes What If You Haven T Filed Taxes For Years Kalfa Law

Can I File An Income Tax Return If I Don T Have Any Income Turbotax Tax Tips Videos